Mental Health Colorado is taking a position on four of the ballot issues now before voters in the 2020 general election. There are eleven total ballot issues—three are referred measures by the legislature, and eight are citizen initiatives.

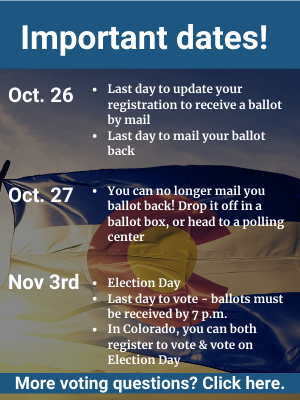

Click here for all of your voting questions!

Families Matter for Mental Health

![]() Proposition 118: Paid Family Leave

Proposition 118: Paid Family Leave

Mental Health Colorado prioritizes supporting families, which yields valuable returns in the long-term health of children and young people. Paid family and medical leave is an essential building block for healthy families, strong communities, and thriving economies.

When we think about the purpose of a human community and the aim of supporting health across the lifespan, we must acknowledge that we are living in a society where many working people have to absorb a damaging financial setback when they take time off for family or medical reasons. There is something inherently unhealthy and inhumane about a society that makes Coloradans choose between paying their bills and providing a strong start for their children or caring for their own or a loved one’s health. – Vincent Atchity, President & CEO, Mental Health Colorado.

Funding for Mental Health

![]() Amendment B

Amendment B

The legislature has referred Amendment B to the ballot with strong bipartisan support. It repeals a decades-old amendment that no longer works as intended and results in a reduction in local revenues that fund public schools, human services, and mental health programs. The repeal of the amendment will ensure that services and programs that are vitally important to individual and community health and wellbeing can remain in place and effective.

Proposition 116: State Income Tax Rate Reduction

More than half of the Coloradans who need care don’t receive it, yet limited public funding poses a constant threat of further reducing access to mental health and substance use care and other services that are essential to wellbeing, like education. Proposition 116 would reduce the state income tax from 4.63% to 4.55%. This reduction would save less than $100 per year for most Coloradans–the biggest tax savings would go to those with incomes of over $1 million per year. Our greatest concern is that the measure would reduce state income tax revenue by $154 million in its first budget year, causing many Coloradans, especially children and young adults, to go without the health care and other vital services that they need to thrive and to contribute to the state’s prosperity.

![]() Proposition EE: Taxes on Nicotine Products

Proposition EE: Taxes on Nicotine Products

The stress and isolation from the pandemic have left many Coloradans more vulnerable than ever to the potential harm of drugs and alcohol, making the successful passage of Proposition EE, Taxes on Nicotine Products, particularly timely. The new tax revenue will be spent on education, housing, tobacco prevention, health care, and preschool.